Basics of Forex Trading – How to Trade Forex Chapter 1

How to trade Forex ? Answering this question is not so simple. Therefore we have dedicated a series of articles to it, with this one being the first.

Piloting the ebb and flow of the forex markets can be as exhilarating as it is challenging. The allure of trading currencies beckons many to delve into the world where price movement dictates the potential for profit or loss. Whether you’re looking to buy or sell British pounds, or any foreign currency, understanding the nuanced dance of exchange rates is key to success in forex trading.

This article is tailored to demystify the process of how to engage in an FX trade, making the complex mechanisms of the foreign exchange market accessible to both novice and seasoned forex traders alike.

How to start trading Forex – Quick overview

Every journey into the Forex markets begins with the crucial step of setting up a trading account—a portal through which the intricate web of buying and selling unfolds. Here, you’re not just trading currencies.

You’re also managing open positions against the relentless tide of market fluctuations. Partnering with reputable forex brokers is essential, as they guide you in interpreting the subtle shifts in the price of a currency pair, which is inherently tied to the exchange rate between two distinct entities—the quote currency and the unit of the base currency.

But what does it mean to buy or sell in the forex context? It’s the fundamental action of exchanging one currency for another in the hope that the price movement will move in your favor, either increasing the value of the base currency against the quote currency or vice versa. As a forex trader, your mission is to forecast these movements with enough accuracy to close your positions when they are most advantageous.

The British pounds in your pocket could rise in value against the US dollar, or any other currency, should the market conditions sway in that direction.

And it’s this potential for swift changes that makes having a robust trading strategy so pivotal. A good strategy acts as a roadmap through the intricate paths of forex trading, enabling traders to navigate price movements, manage risks, and understand when to buy and sell for optimal results.

How to trade Forex – Forex Trading Steps

Don’t know where to start or how to trade Forex? Let us reassure you so read the following steps:

Step 1: Learn About the Forex Market

Before venturing in trading currencies you must understand its mechanisms. It is of utmost importance to consult free trading resources and learn about Forex pairs, the best strategies and types of trading positions.Just as in this article you will learn the basic principles of Forex trading.

Step 2: choose a reliable forex trading platform

Once you start to grasp trading principles, all you need to do to trade the forex markets is find a reliable and well-regulated forex broker. There are a large number of trading platforms

Step 3: Open a demo account with an online broker

We advise you first to do a Forex simulation with a demo account. You can practice and familiarize yourself with the currency market thanks to the virtual capital that the platform puts at your disposal. The eToro broker gives you, for example, €100,000 which you can use for trading on all assets in demo mode.

Step 4: Prepare a Trading Plan

The trading plan is the Forex trader’s roadmap. Roadmap on which it is necessary to define objectives, as well as a set of rules to follow in order to achieve these objectives.

Step 5: Choose a Forex Pair to Trade

Timing is important in forex trading. One might ask “what is the best time of day to speculate on Forex?” “, but also what is the best currency pair to trade during specific times. If you practice trading while having a full-time job, the time slot when you are available and at which you can intervene in the markets should not be a constraint, so here are some indications regarding the financial markets to favor depending on your availability.

Step 6: Analyze the Market

Technical analysis on Forex consists of studying charts, it aims to predict price fluctuations using price history. There are many technical analysis instruments in Forex like patterns, indicators, trendlines and much more. In order to open and close the positions you will need to do technical and fundamental analysis. Unless you intend to use automated trading software.

Step 7: Buy or Sell

Having completed your analysis of the chosen currency pair, you will then be able to decide whether to buy or sell.

In Forex, you buy (go long) when you expect the price of an underlying asset to rise. Similarly, you sell (go short) when you expect the price of an underlying asset to fall.

More about the best trading strategies you can learn in our next Chapter No 2.

Step 8: Monitor Your Positions

The Forex market is highly dynamic and volatile, which presents many opportunities and risks. This is why it is so important to actively monitor your trade positions to ensure that they are in tandem with the prevailing market situation.

How to trade Forex – Understanding a Forex Quote and How to read them

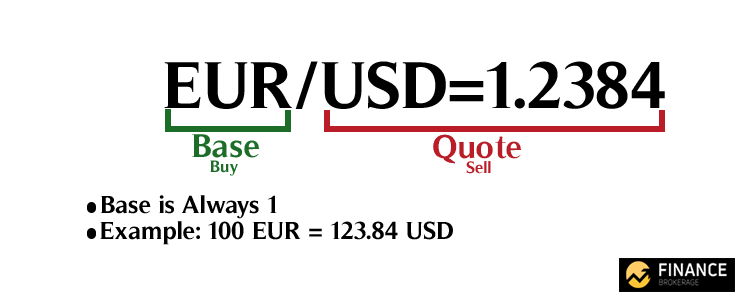

As what you see from the examples earlier, currencies are always quoted in pairs.

All forex quotes are quoted with two prices, the bid and ask. In most cases, the bid is always lower than the ask price.

Bid – this is the price your broker is willing to buy the base currency in exchange for the quote currency. Meaning, the bid is the best available price at which you will sell to the market.

Ask – this is the price your broker will sell the base currency in exchange for the quote currency. The ask is the best available price at which you will buy from the market.

How to trade Forex : concrete example

In this part, we give you a concrete example of Forex trading. For this, we have opted for the EUR/USD currency pair. Here is the information you need to know:

Sale price: 1.1598.

Purchase price: 1.1601.

Price of the pair: around 1.1600.

We therefore deduce that the spread is 3 Pips.

Now consider that your estimates following correct technical analysis indicate that the price will rise to 1.1650.

You therefore open a buy position on Forex trading EUR/USD at the price of 1.1601. Here are the settings you will make.

Take Profit: 1.1650. This means that your position will be automatically closed when the Forex market price reaches this target limit of 1.1650.

Stop Loss: 1.1581. Your position will therefore be automatically closed when the price of the EUR/USD pair reaches this limit value. You therefore agree to lose a maximum of 20 Pips.

Leverage: we opted for a leverage of x30. In other words, the capital mobilized, also known as “margin used” will only represent 0.03% of the total position amount.

Here we have chosen to buy 10,000 units on the USD/CAD pair. This can be translated as purchasing $10,000 in Euros. Note also that in our case:

1 Pip = $1

Margin used = $333.3

2 scenarios can then occur.

The objective is achieved: the price has increased to 1.1650

Your estimates turned out to be correct. The price of the EUR/USD pair has reached the limit value you set, i.e. 1.1650. Your position is then closed automatically and you earn 49 Pips, or $49.

Considering the leverage effect, you make a profit of +14.7% compared to the margin used. However, the Forex price only increased by 0.42%.

That would be all for this chapter.

How to trade Forex – In Conclusion

You will need a lot of patience and dedication to start trading Forex properly. We hope this article provides you with the foundational knowledge needed to begin your forex journey, outlining step-by-step guidance on how to engage with the market. Welcome to the dynamic world of Forex.