Forex Analysis – 3 Types of Analysis

Chapter 6

There are three basic types of forex analysis:

- Technical Analysis

- Fundamental Analysis

- Sentiment Analysis

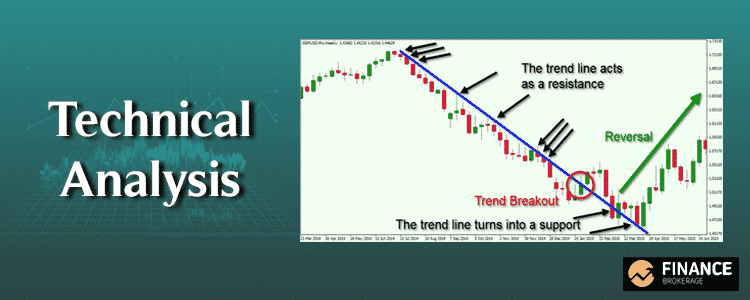

Technical Forex Analysis

Technical analysis is a method of studying of historical price action to allow you determine patterns and probabilities of future movements in the market. This can be done through the use of technical studies, indicators, and other analysis tools.

The reason for using technical analysis is that all current market information is reflected in asset’s price, theoretically.

If that’s the case, then price action is all one would really need to make a trade.

Basically, technical analysis is the same saying that goes, “History tends to repeat itself”. If a price level held as a key support or resistance in the past, you can keep an eye out for it and base trades around that historical price level.

Here’s an example of a technical analysis in action:

As you notice, we use a candlestick chart here. That’s because technical analysis uses charts as they are the easiest way to visualize historical data. And this is why charts are important in forex.

You can observe past data to help you look for spot trends and patterns. Doing this can help you find great reading opportunities.

However, you should know that technical analysis is subjective.

If you and another trader are looking at the exact same chart or indicators, that doesn’t mean you’ll both come up with the same idea of where the price may be headed.

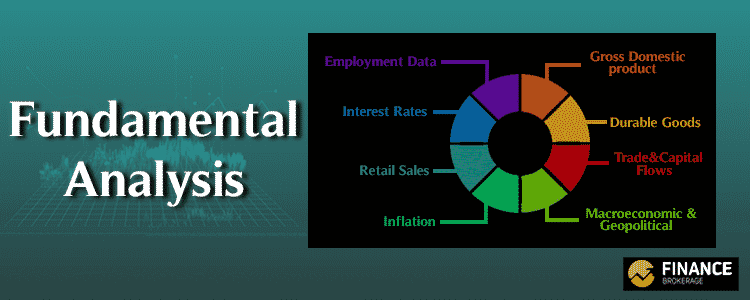

Fundamental Forex Analysis

If technicality is not for you, maybe economics is your cup of tea. The idea here is analyzing economic, politican and social forces that may affect the supply and demand of a currency pair.

Basically, it is supply and demand that determines price, or, in case of Forex, the currency exchange rate.

Relyiong on supply and demand as an indicator of where price is headed is easy. On the other hand, analyzing all the factors that affect supply and demand is hard.

To make it simple, you have to look for different factors to find out which economy is winning and which economy is losing.

You can look for these economic factors found on chapter 3 on What Makes Currency Pairs Move if you haven’t read it yet.

The concept in fundamental analysis is that if a country’s current or future economic outlook is optimistic, that currency should strengthen.

Why does this happen though?

That’s because of a country’s economy is in better shape, more foreign business and investors will invest in the country.

The result?

The need to buy that country’s currency to obtain those assets.

For instance, let’s say the US dollar has been rising because the US economy is improving. As the US economy gets better, raising interest rates may be necessary to control growth and inflation.

That means higher interest rates will make dollar-denominated financial assets more appealing.

And to get your hands on these assets, you will need to buy dollars first. That would likely increase the value of dollar.

See what we mean?

Finally, fundamental analysis is a method of analyzing the strength or weakness of a country’s economy.

Sentiment Forex Analysis

Do you really think that the forex markets reflect all of the information because traders will all just act the same way? Of course not. It’s not just that simple.

This is where sentiment analysis comes in. Each trader has his or how opinion of the market. Each would question why the market is moving this way, and each would react differently whether to trade in the same market or against it.

Basically, the market represents what all traders feel about the market. The position they take represents each trader’s thoughts and opinions. And they all help form the overall sentiment of the market regardless of what information there is.

For retail traders, however, no matter how confident you feel about a trade, you still can’t move the markets in your favor.

For example, if you believe that the euro is going to rise, but everyone else is bearish on it, there’s really nothing you can do.

As a trader, you have to consider all these and conduct a sentiment analysis. It’s up to you to conclude whether the market is bullish or bearish.