Learn to Trade – Learn Forex Basics Chapter 2

Embarking on the journey to learn to trade Forex can be a transformative endeavour for investors seeking to expand their portfolio into the dynamic realm of currency exchange.

With Forex trading, one enters a world where real-time market analysis and movements offer a unique set of opportunities and challenges, particularly for those with a long-term vision. In this chapter, we’ll help you learn how to trade currency.

You will learn all the terms you need to know in order to better understand forex trading. Before you start with technical analysis, you need to acquire basic skills and knowledge.

So, let’s start with learning what pips, leverage, and spreads are before you open an account on a Trading platform.

Learn to trade Forex – What are Pips?

This is probably the first time you heard this word. And that’s going to change from this point on.

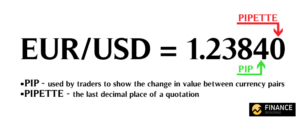

The Price Interest Point, or simply pip, is the price move in a given exchange rate. Knowing the change in value helps traders to enter or edit orders to manage their trading strategy.

If EUR/USD moves from 1.6350 to 1.6351, then that means the USD rise in value is one pip.

Remember, a pip is the last decimal place of a quotation.

The majority of pairs are up to 4 decimal places. But there are some exceptions, like the Japanese yen, as it only goes to 2 decimal places.

Learn How to Trade Forex – What are Pipettes?

Not this kind of pipette.

Some brokers quote currency pairs beyond the standard 4 and 2 decimal places. Instead, they quote 5 and 3 decimal places.

These are called pipettes or Fractional Pips.

If the GBP/USD moves from 1.41498 to 1.41499, the 0.00001 move is one pipette higher.

If the GBP/USD moves from 1.41498 to 1.41499, the 0.00001 move is one pipette higher.

What’s the point of pips?

The value of the pips of your trade can differ depending on your lot size. A lot refers to the smallest available trade size that you place when trading in the forex market. We’ll talk more about lots later.

Going back, when your trade is positive in pips, you’re making a profit. But when it’s negative, your trade is a loss. This is why traders often use pips to reference gains or losses.

Furthermore, the effect of a single pip on the dollar amount depends on the amount of euros purchased. If, for example, a pip was 10 basis points, a one-pip change would cause greater volatility in currency values.

For instance, we have a USD/EUR with a quote of 1.2326. If a trader buys 10,000 euros in US dollars, the price paid will be $8,112.93.

What are lots in Forex?

Lots are basically the number of currency units you will buy or sell. There are different sizes for lots. The standard size for a lot is 100,000 units of currency. The mini size is 10,000, the micro is 1,000, and the nano is 100 units.

If you choose a standard-size lot, you buy 100,000 of the base currency while selling the equivalent number of units of the counter currency. When the ask price of EUR/USD is 1.2500, 100,000 euros are bought, while 125,000 dollars are sold.

The larger the unit size, the fewer pips you need to make a profit or take a loss.

Here’s an example to understand this better.

A standard EUR/USD pip is 0.0001

You gain 1 pip when buying $100,000 EUR/USD at 1.23000 and selling at 1.23001

(0.0001/1.23000) x 100,000 = $8.10 per pip x 1 pip = $8.10 profit.

Next, you gain 10 pips when buying $10,000 EUR/USD at 1.23000 and selling it a 1.23010

(0.0001/1.23000) x 10,000 = 81 cents per pip x 10 pips = $8.10 profit.

You can see how this works in which both trades earned the same profit.

Learn to Trade With Leverage

Leverage is one of the reasons why many people are attracted to trading. It allows you to trade without putting up the full amount. That means you can open orders that can go up to 1,000 times more than your own capital. How awesome is that?!

Let’s explain this further.

In fx trading, what you watch for currency movements are the pips. But these movements are just fragments of a cent. For instance, a forex currency like the EUR/USD moves 100 pips from 1.6700 to 1.6800 is just a 1 cent move of the exchange rate.

This is the reason why transactions should be in large amounts. Hence, the lots.

With a leveraged position, you can magnify the potential gains from any price movements. But losses are also magnified by the same degree.

Now, let’s apply leverage in real-life situations.

Let’s say you want to control a $100,000 position. Your broker will set aside $1,000 from your account. Your leverage is now 100:1.

You’re now in control of a $100,000 position with only $1,000.

Other leverages available are 50:1, 100:1, 200:1 or even higher.

Learn to trade with a margin

Margin is the $1,000 deposit you had to give to use leverage from the example above. It’s a good faith deposit that a trader puts up for collateral to hold open a position. It’s also a portion of your account equity set aside and allocated as a margin deposit.

Remember: The amount of margin needed to hold open a position will ultimately be determined by trade size. If your trade size increases, your margin requirement will increase as well.

But what if the market moves against you and results in losses such that you lack a sufficient amount of margin? This is where the Margin Call comes in. A forex broker closes your positions and limits the losses.

This helps prevent the account from becoming a negative balance.

What are Spreads in Forex?

Citing from chapter one, spread is the difference between the bidding price and the asking price. You have to remember that spread is expressed as pips.

Furthermore, the cost of each transaction is the spread. And this cost can vary from broker to broker.

A spread is the easiest way for brokers to get compensated for each transaction you make. Here’s an example to understand spreads in the simplest way:

EUR/USD has a price of 1.2321. You decided to buy the pair, but the asking price won’t be exactly 1.2321. It’ll probably be more, maybe 1.2323, which is the price you’ll pay.

On the other hand, the seller of the trade won’t receive the full 1.2321. Rather, a little less with 1.2319. The 0.0004 pip is the spread. That’s what a broker keeps for taking the risk and assisting the trade.

Sure, the 0.0004 EUR spread isn’t much. But if the trade is larger, a small spread can quickly add up.

Now that you know how to trade currencies, next chapter we’ll teach you how to find out the currency pairs.

Learn To Trade Using Demo Account

All these basic and essential Forex concepts might seem simple. And they are but only if you fully understand how they work. The best way to learn Forex trading is by opening a demo account. Choose your trading platform, open a demo account and try it out.

FAQs about Learn Forex Basics

What are the best resources for learning a trade?

One of the most popular courses is Learn To Trade. The course is created by experienced trader Greg Secker.

How to Learn Trading?

- Read investment books

- Read financial articles

- Open demo trading account

- Find a mentor

- Monitor and analyze the market

- Attend seminars and take classes

Is trading easy to learn?

The ease of learning trading depends on various factors, including your prior knowledge, dedication to learning, and willingness to practice and gain experience. While some people may find trading relatively straightforward to grasp, others might encounter challenges along the way.

Is it smart to learn a trade?

Trade jobs are an excellent career option for anyone looking to acquire professional skills or a secure job with a steady income. Learning a trade involves a variety of practical skills and specialized knowledge that you can gain through attending trade school or by being an apprentice.