The dollar index at 105.20 ahead of CPI, and the Fed reports

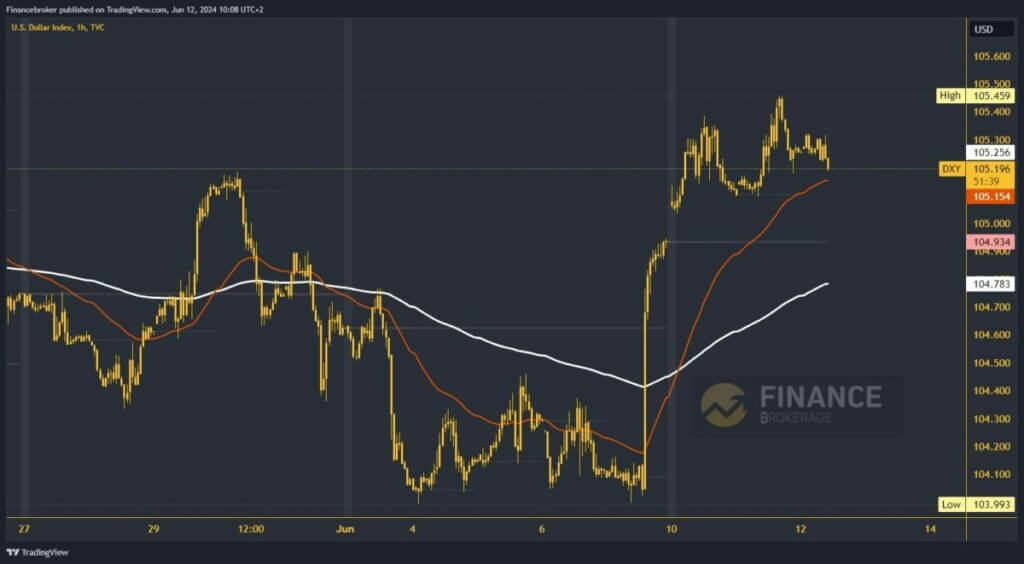

- The new weekly high of the dollar index was formed yesterday at the 105.45 level.

Dollar index chart analysis

The new weekly high of the dollar index was formed yesterday at the 105.45 level. The index continued to rise with the support of the EMA50 moving average. During this morning’s Asian trading session, the dollar moved in the 105.20-105.30 range. We are still in this narrow range, with slight pressure on the lower range line.

This would initiate an impulse below and the formation of a new daily low. We would again hold above the EMA50. Failure to do so moves us to a new low of 105.10. Below this level we have an empty space that created a bullish gap from the market opening on Monday morning. Increased bearish momentum will have an opportunity to close the gap and test the weekly open price at 104.93.

Does the dollar have the strength to hold above the 105.00 level?

Potential lower targets are 104.90 and 104.80 levels. Additional major support is in the EMA200 at the 104.80 level. For a bullish option, we need to hold above the 105.20 level. After stabilizing at that level, the dollar index could start a positive consolidation up to 105.45, this week’s high. The new testing of that level in the last two days will have the opportunity to break through that resistance and form a higher high with an impulse. Potential higher targets are 105.50 and 105.60 levels.

Data on German inflation and British GDP were published in the EU session at the start. The data was in line with forecasts, and there were no surprises. Very important news for the dollar index awaits us in the afternoon in the US session. First, we have US CPI; annual inflation is expected to be at the same level as before. After that, the FED will announce the future interest rate. The forecast is that it will remain the same, and it will be interesting to watch how the dollar index behaves during that announcement.