Trends and Volume Spread Analysis

Chapter 1: AN INTRODUCTION

In the previous discussions, we have established that if you want to become a good trader, which leads you to even generate more profit in the stock market, you should not take any professional opinion for granted. This means, that once there was progress in a move, it will be easy for you to recognize the underlying trend in price and go with the flow.

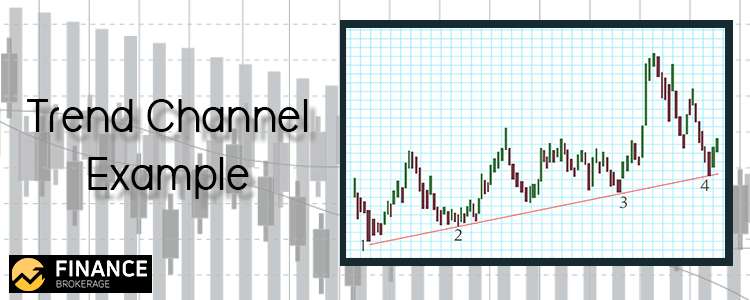

Timing moves and maintaining your awareness of the underlying market flow can be well understood through knowledge with trending. At this point in time, there has been no scientific research about trending and trend lines. Hence, we can’t guarantee an absolute understanding of how trend lines, financial market, forex market, price bar and etc. work.

Be that as it may, allow us to give you some insights regarding the nature of trend lines. After many years of study and thorough research, we can show you how it works and how it represents resistant areas to prices.

——————————————————————-

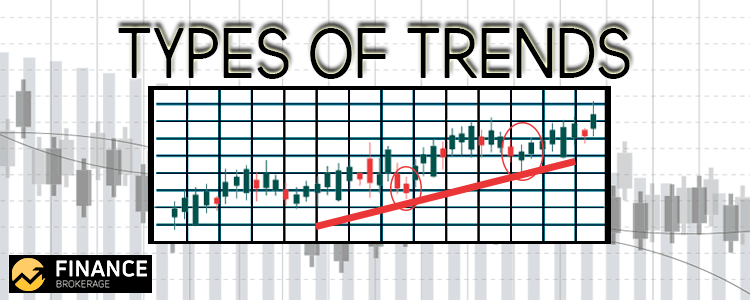

TYPES OF TRENDS

First and foremost, we will discuss the types of Trends.

What are the different types of Trends?

There are three different types of trends namely: Secular Trend, Primary or Long-Term Trend, and, Secondary or Short-Term Trend.

What is a Secular Trend?

The secular trend is ought to be the first and strongest trend for traders to know. It is a trend that lasts between 7 to 15 years and commonly concurs with underlying conditions of the economy. On one hand, a secular bear market is when the trend of the market goes down sideways for years.

A secular bull market, on the other hand, is when there’s an upward movement of the market’s trends for years. The shorter-term bear markets are more probable in meeting support and rebound to bullishness during a bull secular market.

Meanwhile, a secular bear market can have a 10-year observation or longer on a chart. Take note that there are certain periods with upward and downward movements of market trends – this is called the primary trend. Observe the chart below.

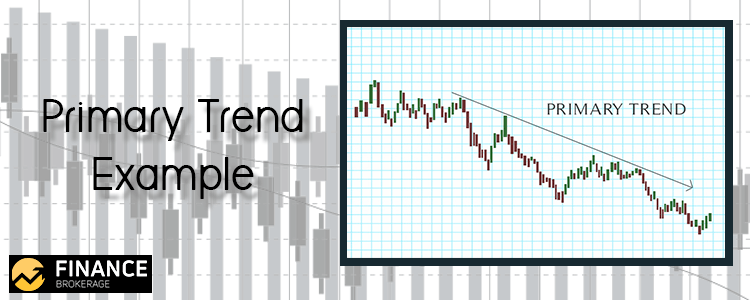

What is a Primary or Long Term Trend?

Within a secular market, the largest measurable movement of price is the primary trend. These trends have a duration of 3 to 5 years depending on strength. Remember that the bearish primary trends are stronger and last longer compared to bullish primaries during a secular bear market. See the chart below.

What is a Secondary or Short Term Trend?

Trends within the primary are secondary trends. These are news-and-events-driven trends. Further, these are close and short-term rallies and dips.

What is the importance of trend analysis?

Analyzing the trend is important in order for us to get a better understanding of why a certain trend is likely to profit compared to the other. For an instance, assuming the market is trending lower in the primary trend, consequently, there would be a lesser probability for a bullish play on the secondary trend to work compared to a bearish one.

Also, if a signal in the secondary trend justifies the primary trend, hence, there would be a higher probability of profiting. And the key towards having a great trade is to have many frames in confirmation as possible.

For binary traders, the secular trend would be really long, however; starting with the primary trend is recommended. After identifying the primary trend, look for a secondary trend and then a near trend. Keep in mind that if all three trends are aligned, it usually indicates a higher chance of success.